The electric vehicle revolution has reached a critical inflection point. After decades of gradual progress, battery prices have finally crashed to levels that make electric vehicles not just competitive with gasoline cars, but potentially cheaper. At the center of this transformation stands CATL (Contemporary Amperex Technology), the world’s largest battery manufacturer, which has achieved something the industry once thought impossible: making batteries from table salt that outperform traditional lithium technology while costing a fraction of the price.

This isn’t just another incremental improvement in battery technology. CATL’s breakthrough represents a fundamental shift in how we think about energy storage, transportation economics, and the materials that power our future. By 2025, the company expects to begin mass production of sodium-ion batteries that could drive electric vehicle prices below their gasoline counterparts permanently.

The Staggering Scale of Battery Price Decline

To understand the magnitude of CATL’s achievement, consider this: in 2008, lithium-ion battery packs cost $1,415 per kilowatt-hour. By 2024, the global average had dropped to $115 per kWh, representing a 92% reduction over 16 years – a pace of cost improvement that rivals the famous Moore’s Law in computing.

But China, led by companies like CATL, has accelerated far beyond the global average. Current bidding for energy storage systems in Chinese markets shows prices as low as $65-70 per kWh for complete battery systems, with individual lithium iron phosphate (LFP) cells trading at $53-56 per kWh in wholesale markets. This dramatic cost reduction reflects China’s growing dominance in the global battery wars, where Western manufacturers struggle to compete with Chinese scale and cost advantages.

This price collapse has been driven by five key factors that CATL has mastered better than any other manufacturer:

Overcapacity and Market Competition: Chinese battery manufacturers built so much production capacity that supply now far exceeds global demand. When companies fight for survival, profit margins disappear, driving prices to near-material costs.

Vertical Integration: CATL controls everything from raw material processing to final assembly. From lithium processing to graphite manufacturing, cathode production to final assembly, the company eliminates middleman markups and reduces supply chain vulnerabilities.

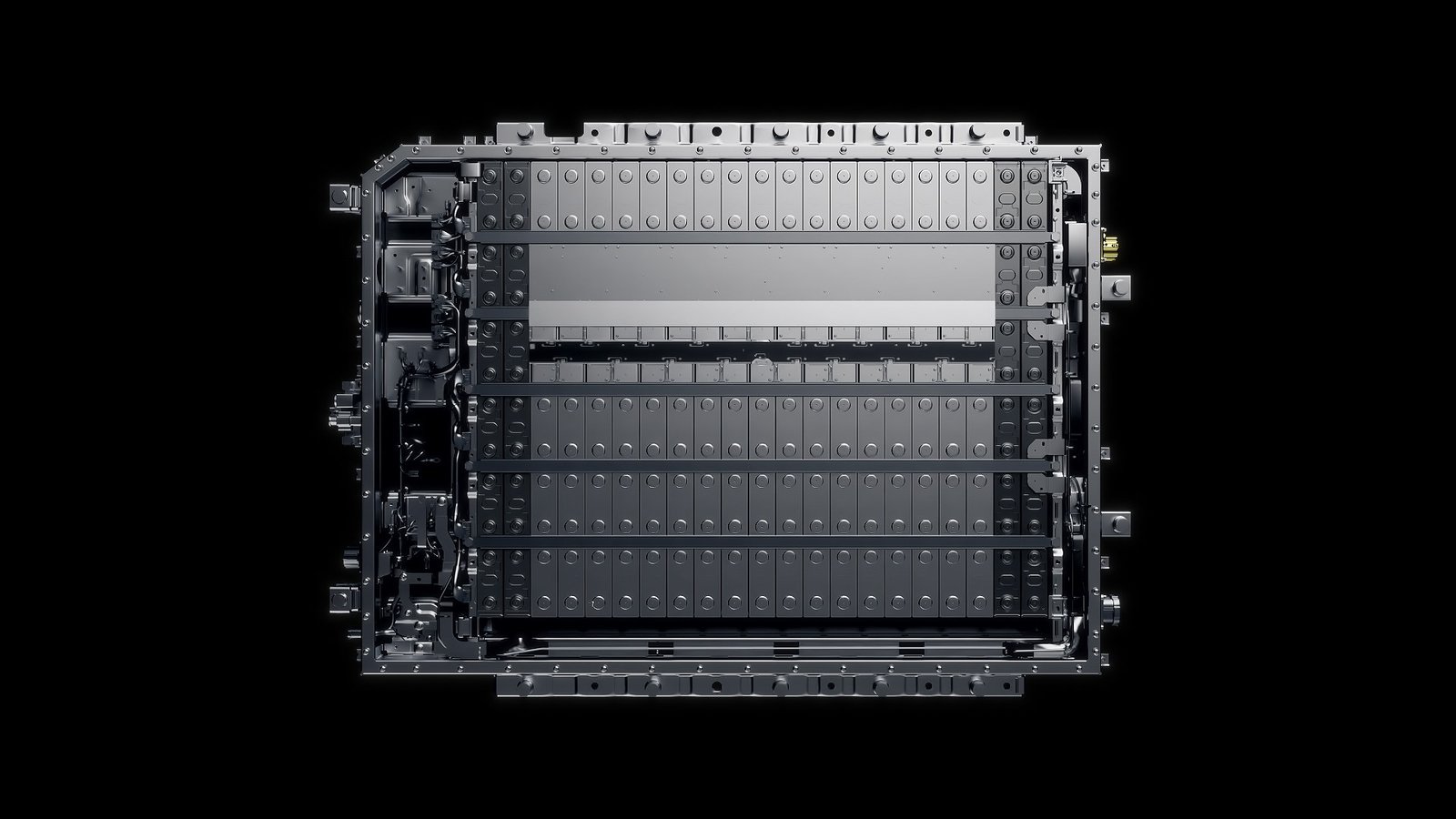

Advanced Packaging Technologies: Their cell-to-pack (CTP) architecture, particularly the Qilin 3.0 system, achieves 72% volume utilization compared to traditional designs that waste significant space on cooling and structural elements.

Chemistry Optimization: By focusing heavily on LFP chemistry, CATL avoids expensive materials like nickel and cobalt, using abundant iron and phosphate instead.

Manufacturing Scale: CATL operates mature factories with optimized processes and can retool existing lithium production lines to manufacture sodium batteries using nearly identical equipment.

The result is that batteries have essentially become a commodity product in China, where material costs often exceed manufacturing expenses and profit margins combined.

The Sodium-Ion Revolution: Why Salt Beats Lithium

CATL’s most audacious bet isn’t just about making lithium batteries cheaper – it’s about replacing lithium entirely with sodium, the sixth most abundant element on Earth and a major component of seawater. This represents a fundamental shift in battery chemistry that addresses several critical limitations of current lithium technology.

The company’s new Naxtra battery technology claims to solve the historical problems that have kept sodium batteries in the laboratory. According to comprehensive analysis of CATL’s Naxtra specifications, the technology achieves 175 watt-hours per kilogram energy density, over 10,000 charge cycles, and operates from -40°C to +70°C while retaining 90% of capacity at extreme temperatures.

These numbers deserve scrutiny. Tesla’s current LFP batteries typically last 3,000 to 4,000 charge cycles before dropping below 80% capacity. If CATL’s 10,000-cycle claim proves accurate in real-world conditions, we’re looking at batteries that could theoretically power a vehicle for millions of miles before significant degradation.

The temperature performance is equally significant. Current lithium batteries struggle in extreme cold, limiting electric vehicle adoption in northern climates. Sodium batteries naturally handle temperature extremes better, which could open entire geographic markets that have been difficult for EVs to penetrate.

CATL says this translates to over 500 kilometers of driving range, covering the vast majority of daily driving needs. While this remains behind premium nickel-based lithium batteries that achieve 250-300 Wh/kg, it’s competitive with the LFP batteries that already power millions of vehicles worldwide.

The abundance factor cannot be overstated. Unlike lithium, which is concentrated in specific geographic regions and requires complex extraction processes, sodium can be extracted from seawater virtually anywhere. This could eliminate the geopolitical complexities and supply chain vulnerabilities that currently plague lithium battery production.

However, several challenges remain. Manufacturing sodium batteries at scale requires retooling production lines and developing new supplier relationships. The technology also faces a classic catch-22: it needs scale to achieve promised costs, but it needs low costs to achieve scale. CATL’s advantage lies in their ability to leverage existing lithium production infrastructure, as sodium cells use nearly identical manufacturing processes.

While sodium represents a compelling alternative, other advanced technologies are also emerging. Research into solid-state battery technology continues to promise revolutionary improvements in energy density and safety, though commercial viability remains years away.

Freevoy: The Intelligent Hybrid Approach

While sodium represents CATL’s long-term vision, their Freevoy technology offers a pragmatic intermediate solution that’s already shipping in commercial vehicles. Technical analysis of CATL’s Freevoy system shows how this hybrid battery technology achieves 400 km electric range by combining sodium-ion and lithium-ion technologies in a single pack, allowing the system to optimize performance based on specific conditions and requirements.

Think of Freevoy as the Swiss Army knife of batteries. It comes in three configurations: classic LFP, high-performance nickel manganese cobalt (NMC), and now sodium-ion. Each chemistry brings specific strengths, and Freevoy’s power management system intelligently switches between them.

Since launching in October 2024, CATL has refined this technology beyond simply connecting different battery types. The company has optimized cell ratios and connections to improve temperature range by 5% and extend electric range by over 10 kilometers compared to single-chemistry packs.

The system uses sodium as a state-of-charge benchmark to calibrate the lithium-ion battery’s charge level, improving overall system efficiency while addressing each chemistry’s weaknesses with the other’s strengths. Cold weather performance relies on sodium, while maximum range applications switch to lithium.

Thirty different vehicle models from brands including Geely, Chery, GAC, and Voyah are scheduled to launch with Freevoy batteries in 2025. These aren’t concept cars – they’re production vehicles hitting showrooms across multiple markets.

This hybrid approach represents a significant evolution from the industry’s previous assumption that one battery chemistry must serve all applications. Instead, CATL is pioneering a future where different use cases demand different solutions, optimized for specific performance requirements.

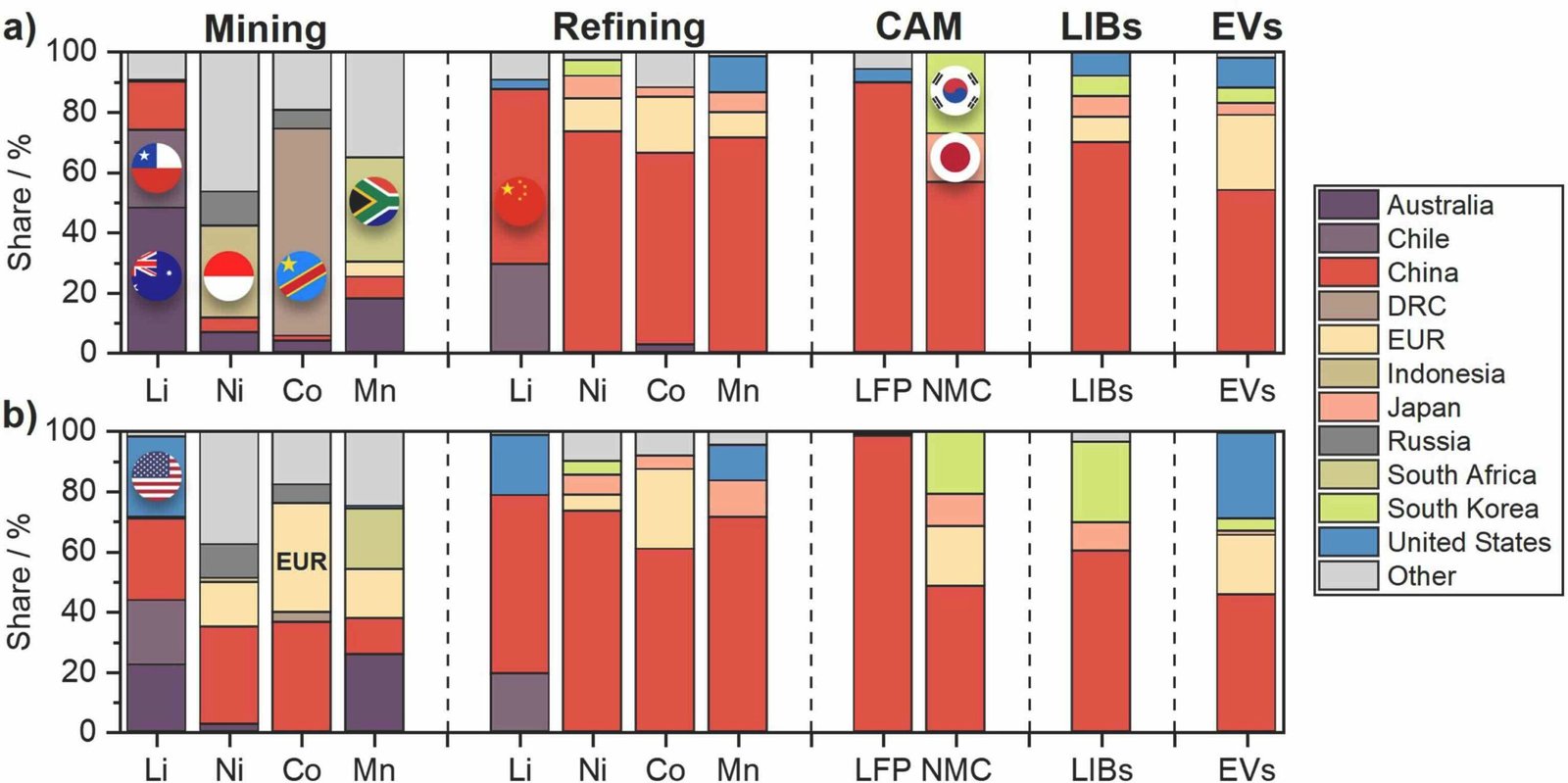

The Global Context: China’s Battery Dominance

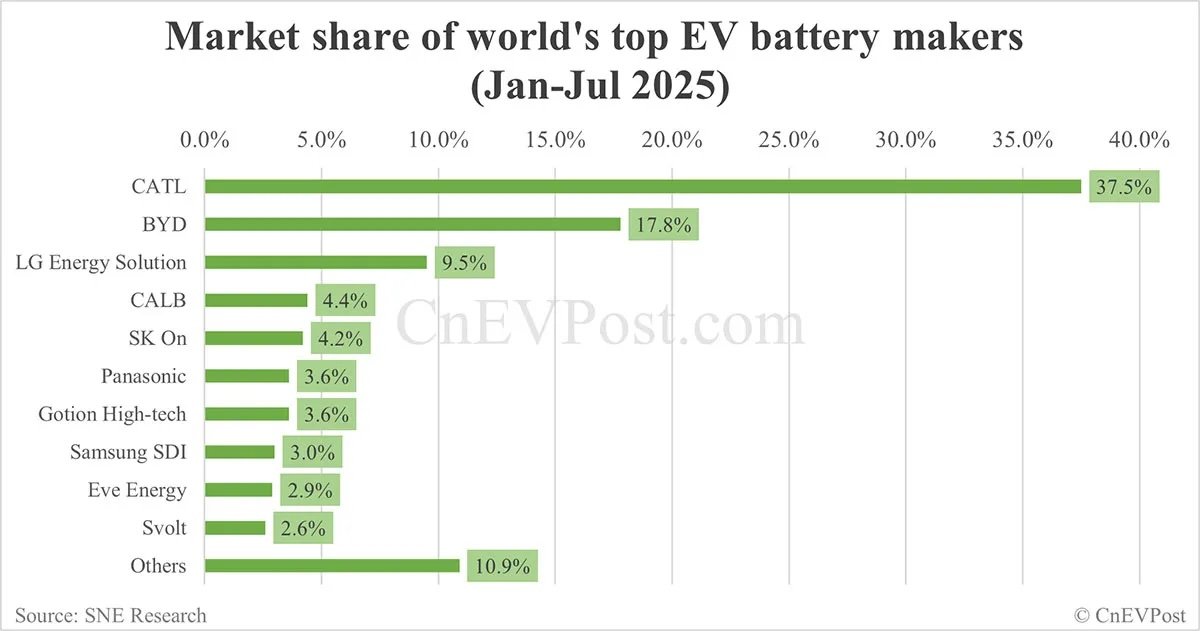

CATL’s innovations don’t exist in isolation – they’re part of China’s broader strategy to dominate the global battery supply chain. According to the International Energy Agency’s Global EV Outlook 2025, Chinese companies now control approximately 55% of the global battery market, a position built on aggressive investment, vertical integration, and scale advantages that Western competitors struggle to match.

This dominance extends beyond simple market share. Chinese companies control critical parts of the battery supply chain, from lithium processing to cathode material production. CATL alone commands about 40% of global EV battery installations, with their batteries powering over 18 million vehicles worldwide.

The competitive landscape becomes more complex when considering alternative technologies. Mercedes-Benz has officially partnered with Factorial Energy to develop solid-state battery technology, which promises higher energy density and faster charging than current lithium-ion systems. However, solid-state batteries remain expensive and difficult to manufacture at scale.

Similarly, researchers at Chalmers University have developed structural battery composites that integrate energy storage directly into vehicle structures, potentially reducing overall vehicle weight and cost. These innovations represent different approaches to the same fundamental challenge: making electric vehicles more affordable and practical than gasoline cars.

The competition is intensifying as Chinese companies challenge established players in the solid-state battery space. Analysis of the global solid-state battery industry shows how China is accelerating development of a complete solid-state battery ecosystem, competing directly with Western companies. As Chinese companies intensify competition with established solid-state players, this technological arms race benefits consumers through faster innovation and falling prices, but also creates strategic challenges for countries dependent on foreign battery technology.

Industry Response and Future Competition

CATL’s sodium battery announcement has prompted responses from competitors across the globe. BYD, CATL’s primary Chinese rival, has achieved similar cost reductions with their Blade battery technology, though using traditional LFP chemistry rather than sodium.

Western battery manufacturers face pressure to accelerate their own cost reduction efforts while maintaining technological differentiation. Companies like LGES, SK On, and Northvolt are investing heavily in advanced manufacturing techniques and next-generation chemistries to remain competitive.

The competition extends beyond traditional battery companies. Automotive manufacturers are increasingly investing in battery technology directly, recognizing that energy storage will be a key differentiator in electric vehicles. Tesla’s battery research efforts, GM’s Ultium platform, and Ford’s partnerships with battery suppliers reflect this strategic shift.

Startups continue to pursue alternative approaches, from solid-state batteries to lithium-metal anodes to entirely different chemistries. Advanced research into structural battery composites suggests future vehicles where the battery becomes part of the structural framework, eliminating weight and packaging constraints. This technological diversity suggests that the battery industry will remain dynamic and competitive, driving continued innovation and cost reductions.

The regulatory environment also influences competitive dynamics. Government policies on domestic battery production, critical mineral sourcing, and trade restrictions affect which technologies gain market traction in different regions.

Debunking the $10 Per kWh Myth

The internet has been buzzing with claims that CATL’s sodium batteries cost as little as $10 per kilowatt-hour. This figure has been repeated across social media and technology blogs, but our research reveals no confirmation of this price point from any primary source.

We examined official CATL announcements, industry reports, and academic research from institutions like Stanford University. None of these authoritative sources mention $10 per kWh pricing for any CATL battery technology, including sodium-ion.

The reality is impressive enough without exaggeration. Current Chinese battery prices have crashed to levels that seemed impossible just a few years ago. Energy storage system bidding in China shows prices of $65-70 per kWh for complete systems, while individual LFP cells trade at $53-56 per kWh in wholesale markets.

These verified price points still represent a revolutionary achievement. The $65-70 per kWh figure for complete energy storage systems is more than six times higher than the mythical $10 price, but it’s still low enough to fundamentally change the economics of electric vehicles and grid-scale energy storage.

The persistence of the $10 figure highlights a broader challenge in technology journalism: the tendency for impressive but unverified claims to spread faster than factual reporting. This phenomenon is particularly problematic in rapidly evolving fields like battery technology, where legitimate breakthroughs can seem almost impossible to outside observers.

Manufacturing Timeline and Market Reality

CATL has announced that mass production of Naxtra sodium batteries will begin in December 2025, with initial focus on commercial vehicles and energy storage applications before expanding to passenger cars. This timeline represents a significant acceleration from the company’s original projections, which called for sodium supply chains to be established by 2023.

The delay reflects the genuine challenges of scaling new battery chemistries. Manufacturing sodium batteries requires different quality control processes, modified production equipment, and new supplier relationships. Even though the basic manufacturing steps remain similar to lithium batteries, the details matter enormously at industrial scale.

Market adoption faces additional hurdles beyond manufacturing. Consumers must develop confidence in a new battery chemistry, automakers need to modify vehicle designs, and charging infrastructure may require updates to optimize for different battery characteristics.

Early adopters will likely be commercial fleets and budget-conscious consumers in emerging markets, where lower costs outweigh concerns about cutting-edge technology. Premium vehicles will probably stick with proven lithium technologies until sodium batteries demonstrate long-term reliability in real-world conditions.

The geographic rollout will also be gradual. China will see the first large-scale deployments, followed by other Asian markets, and eventually Europe and North America as regulatory approval processes complete and consumer acceptance grows.

Economic Implications: When Batteries Become Cheap

If battery prices continue their dramatic decline, the implications extend far beyond the automotive industry. This cost reduction could accelerate the deployment of renewable energy by making grid-scale storage economically viable in most markets.

Home energy storage could transition from a luxury product for early adopters to standard equipment in new construction. Installing a battery backup system might cost less than high-end kitchen appliances, fundamentally changing how residential customers interact with the electrical grid.

The automotive implications are equally profound. Electric vehicles could not only reach price parity with gasoline cars but significantly undercut them. When batteries become cheap enough, the superior efficiency of electric drivetrains creates a permanent cost advantage that internal combustion engines cannot match.

This transition would accelerate the obsolescence of gasoline infrastructure, creating stranded assets in oil refining, gas stations, and traditional automotive supply chains. Countries and companies heavily invested in fossil fuel infrastructure face significant economic adjustments as transportation electrifies.

The geopolitical implications are substantial. Countries that control battery supply chains gain strategic advantages similar to those historically enjoyed by oil producers. China’s current dominance in battery manufacturing could create new forms of energy dependence for importing nations.

Technical Challenges and Limitations

Despite the impressive progress, sodium batteries still face legitimate technical challenges that could limit their adoption. Energy density remains lower than premium lithium technologies, which matters for applications where weight and space are critical constraints.

The cycle life claims require verification through real-world testing over multiple years. Laboratory conditions don’t always translate to practical applications, especially in demanding automotive environments with temperature cycling, vibration, and varied charging patterns.

Manufacturing consistency at scale presents another challenge. CATL has demonstrated impressive capabilities in lithium battery production, but sodium batteries may require different quality control processes and have different failure modes that only become apparent during mass production.

The charging infrastructure implications deserve consideration. While sodium batteries can use existing charging systems, optimal charging algorithms may differ from lithium batteries. Fast charging capabilities and thermal management requirements could necessitate infrastructure updates in some applications.

Safety characteristics, while generally favorable for sodium batteries, require extensive real-world validation. The automotive industry’s conservative approach to safety means that new battery chemistries face years of testing before widespread adoption in passenger vehicles.

Looking Forward: The Battery Landscape of 2030

By 2030, the battery industry will likely look dramatically different from today. Multiple chemistries will serve different applications, with sodium potentially dominating cost-sensitive uses while advanced lithium technologies continue serving premium applications.

Manufacturing will be more distributed globally as countries invest in domestic battery production capabilities. The current concentration in China will decrease as other regions build competitive manufacturing ecosystems, though China will likely maintain significant advantages in scale and cost.

Energy density improvements will continue, but cost reduction may become the primary competitive factor for most applications. As batteries become cheap enough for widespread deployment, performance optimization will focus on durability, safety, and manufacturing efficiency rather than maximum energy density.

The integration of batteries into broader energy systems will deepen. Vehicles will increasingly serve as mobile energy storage, feeding power back to homes and grids during peak demand periods. This vehicle-to-grid functionality could create new revenue streams for electric vehicle owners while supporting renewable energy integration.

Conclusion: A Transformative Moment

CATL’s achievements in battery cost reduction and sodium-ion technology represent more than incremental progress – they signal a fundamental transformation in global energy systems. When batteries become cheap enough to deploy everywhere, the economic advantages of electric transportation and renewable energy become overwhelming.

The transition won’t be immediate or uniform. Different regions will adopt new technologies at different rates, influenced by local economic conditions, regulatory frameworks, and infrastructure capabilities. But the direction is clear: batteries are becoming a commodity product, and that changes everything.

For consumers, this means electric vehicles that cost less to buy and operate than gasoline cars. For energy systems, it means renewable power that can be stored and dispatched whenever needed. For global economics, it means a shift away from fossil fuel dependence toward electrified systems powered by abundant materials.

The companies and countries that navigate this transition successfully will shape the energy landscape for decades to come. CATL’s sodium battery breakthrough may be remembered as the moment when cheap, abundant energy storage became reality rather than aspiration.

Whether sodium batteries fulfill their promise or give way to other technologies, the trajectory is unmistakable: the expensive battery era is ending, and the implications will reshape transportation, energy, and economic systems worldwide.

Essential Tools for Battery Technology Research & Content Creation

To stay ahead of the rapidly evolving battery and electric vehicle landscape, we’ve curated a selection of professional tools that power our research and content creation process:

Video Creation & Education

Creating compelling educational content about complex technologies requires professional-grade video tools. Fliki transforms research articles into engaging video content with 20% OFF available. Pictory excels at creating data-driven visualizations from technical reports with code CuriosityAI for 20% OFF. For professional presentations on battery technology developments, Synthesia provides AI-powered video creation capabilities.

Professional Audio Production

Technical content demands crystal-clear audio delivery. ElevenLabs offers industry-leading AI voice synthesis for multilingual content distribution, while Murf AI provides professional voiceover solutions for educational materials.

Research & Analytics

Tracking battery technology developments requires robust analytical tools. vidIQ helps optimize content discovery for technology education, while AdCreative.ai assists in creating compelling visuals for complex technical concepts. For advanced marketing analytics, Multiplier provides comprehensive campaign tracking.

Content Distribution & Growth

Building an audience for technical content requires strategic distribution. Beehiiv powers professional newsletter creation for technology insights, enabling researchers to share complex findings with broader audiences effectively.

Professional Development & Healthcare

The battery technology field evolves rapidly, requiring continuous learning. Coursera offers specialized courses on energy storage, materials science, and clean technology from leading universities worldwide. For healthcare professionals researching battery safety and environmental impacts, CarePatron provides comprehensive practice management solutions.

Digital Security for Research

Protecting research data and maintaining privacy while accessing international technical sources is crucial. Surfshark VPN provides secure access to global research databases and technical publications, while NordVPN offers enterprise-grade security for sensitive research work.

These tools form the foundation of professional technology research and content creation, enabling deeper analysis of complex topics like CATL’s battery innovations and their broader implications for global energy systems.