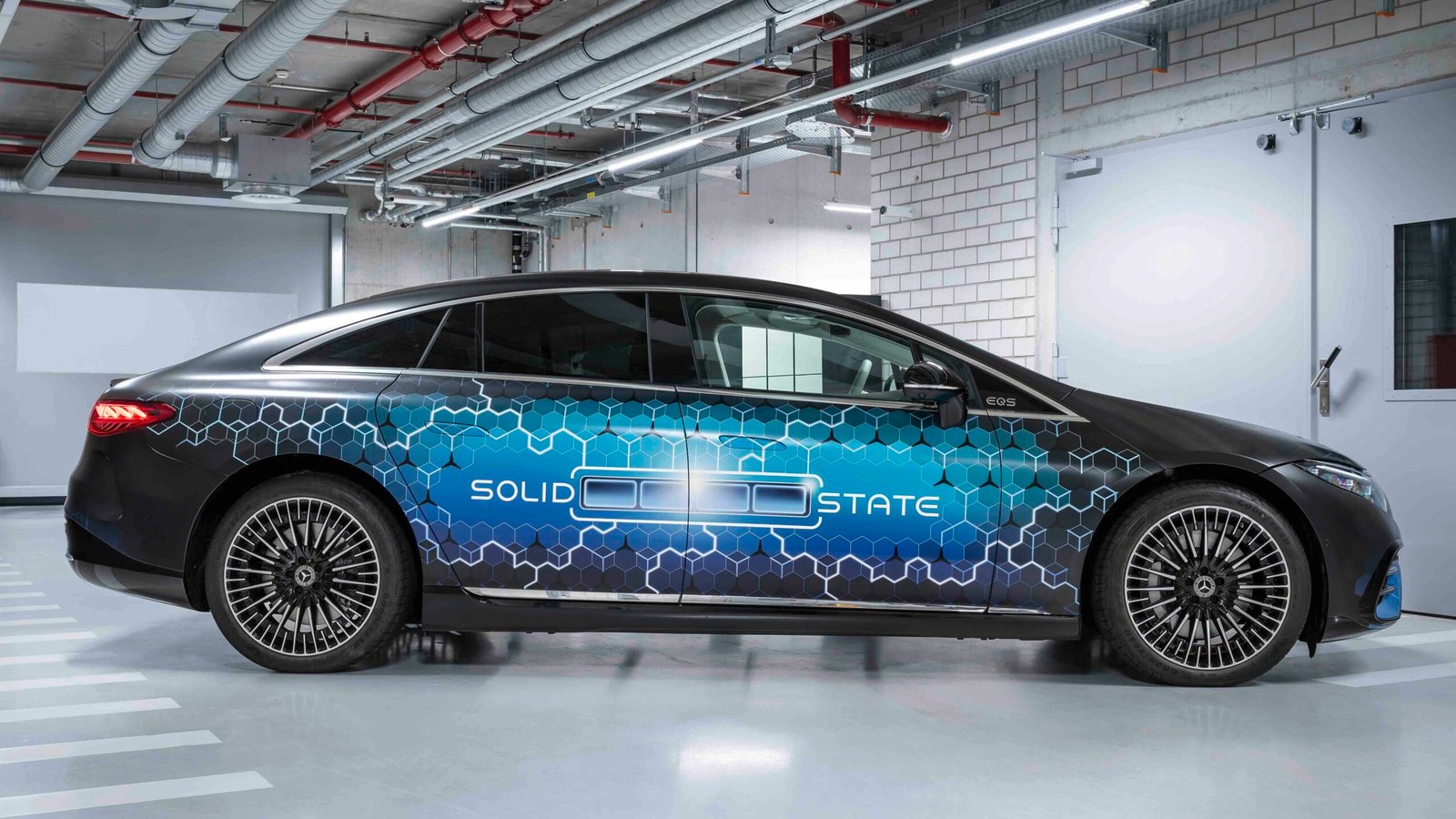

After ten years of broken promises and failed prototypes, solid-state batteries are finally transitioning from laboratory curiosities to road-tested reality. Mercedes-Benz is currently driving an EQS equipped with Factorial Energy’s solid-state cells, achieving over 1,000 kilometers of range on a single charge. This breakthrough represents a pivotal moment in electric vehicle technology, potentially reshaping the automotive landscape and challenging the current dominance of lithium-ion batteries.

The significance of this achievement cannot be overstated. While companies like Toyota, QuantumScape, and even Dyson have spent billions pursuing solid-state technology with limited success, Factorial Energy has managed to create working prototypes that demonstrate real-world viability. According to Mercedes-Benz Group’s official announcement, their test vehicle represents more than just improved range—it showcases a technology that could eliminate many of the current limitations holding back mass EV adoption.

Watch the Complete Analysis

For an in-depth exploration of solid-state battery technology and the competitive landscape between Mercedes, Toyota, Samsung, and other major players, watch our comprehensive video analysis. We break down the technical challenges, manufacturing realities, and realistic timelines that will determine which companies succeed in bringing solid-state batteries to market.

► Watch: Solid-State Batteries Finally Work – Mercedes 1000km vs Tesla’s Limits

The video covers additional details on:

- Technical comparison between FEST, sulfide, and ceramic approaches

- Manufacturing yield challenges that have destroyed previous attempts

- AI acceleration through Factorial’s Gammatron platform

- Investment flows and partnership strategies

- Realistic cost projections through 2030

Subscribe to stay updated on breakthrough battery technologies and their real-world impact on the automotive industry.

The Decade-Long Journey to Solid-State Reality

Source: Factorial

The history of solid-state battery development reads like a series of ambitious promises followed by disappointing delays. Toyota first announced plans for solid-state batteries in consumer vehicles by 2020, a deadline that came and went without commercial implementation. QuantumScape, backed by Volkswagen and billions in investment, has repeatedly pushed back production timelines while struggling with manufacturing challenges that proved more complex than anticipated.

Perhaps the most dramatic failure was Dyson’s electric vehicle program, which consumed $2.5 billion before being canceled in 2019. The British technology company’s inability to solve solid-state battery manufacturing at scale forced them to abandon their entire automotive ambitions, as detailed in this comprehensive Reuters analysis, highlighting the enormous technical and financial risks inherent in this technology.

The core challenge has remained consistent across all these attempts: lithium metal anodes create dendrites—microscopic metallic structures that grow during charging cycles and eventually pierce through the battery separator, causing short circuits and potentially dangerous failures. Traditional liquid electrolytes cannot effectively prevent this dendrite formation, leading to batteries that either fail quickly or require complex management systems that negate their theoretical advantages.

Understanding these historical failures provides crucial context for evaluating current claims about solid-state battery breakthroughs. The graveyard of failed solid-state ventures serves as a reminder that laboratory performance rarely translates directly to commercial viability, especially in the demanding automotive environment where batteries must function reliably for hundreds of thousands of miles across diverse operating conditions.

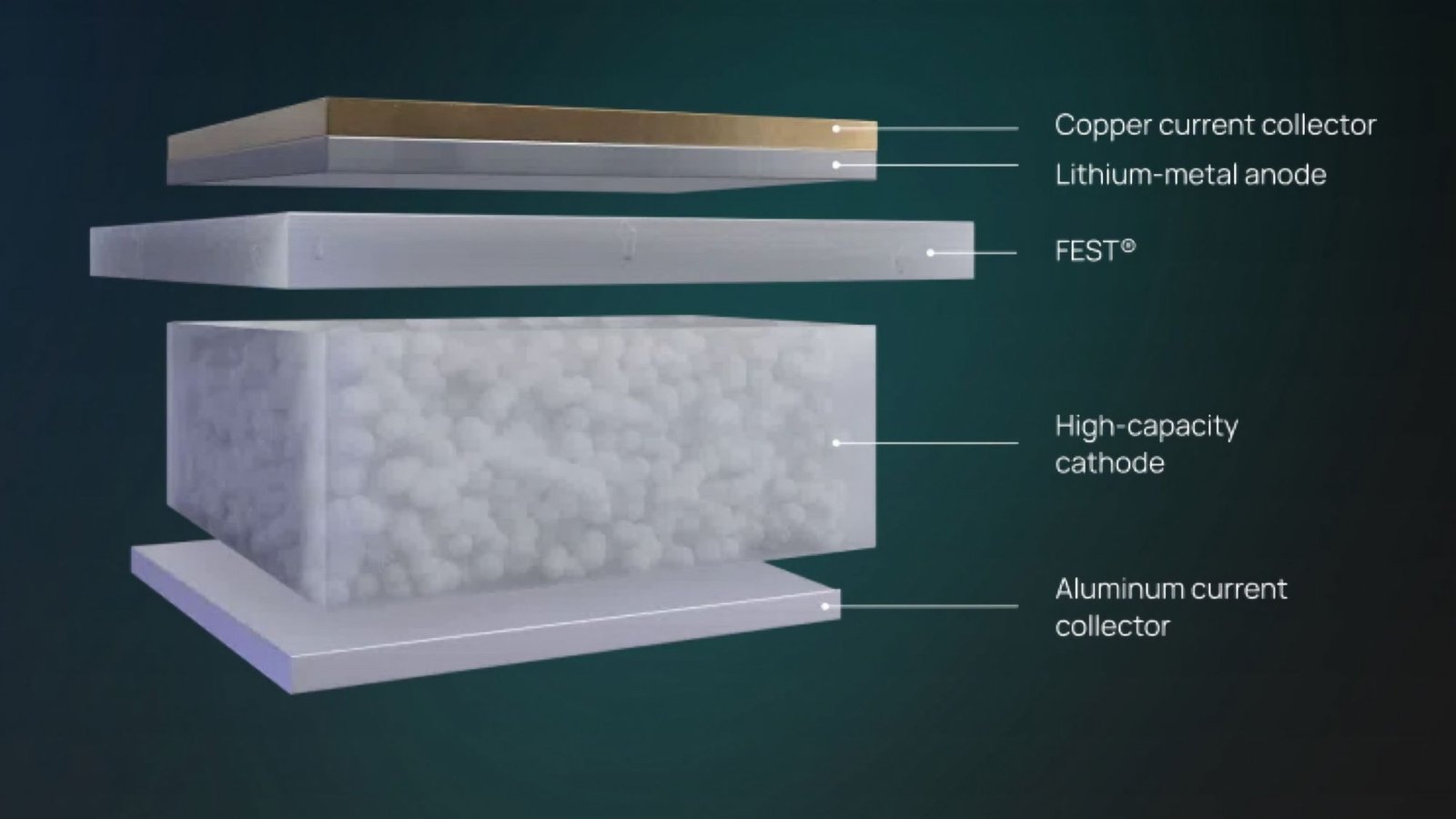

Factorial Energy’s FEST Technology: A Different Approach

Source: Futurride

Factorial Energy’s breakthrough centers on their proprietary FEST (Factorial Electrolyte System Technology), which represents a quasi-solid approach that differs significantly from the all-solid-state designs pursued by many competitors. FEST employs a solid electrolyte system that maintains compatibility with existing lithium-ion manufacturing infrastructure, potentially solving one of the industry’s most persistent challenges: how to scale production without building entirely new facilities.

The technical specifications validated by Stellantis demonstrate the maturity of Factorial’s approach. Their 77 amp-hour cells achieve 375 watt-hours per kilogram energy density—approximately 50% higher than current Tesla battery technology. Research published in Nature Communications provides additional context on solid-state battery development challenges and recent breakthroughs, showing how Factorial’s approach addresses many persistent technical issues.

More importantly, these cells can charge from 15% to 90% capacity in just 18 minutes while maintaining stable operation across temperatures ranging from -30°C to +45°C. This temperature tolerance represents a crucial advantage over many solid-state designs, which often struggle with performance degradation in extreme conditions. The ability to function effectively in both Arctic winters and desert summers without complex thermal management systems could significantly reduce the cost and complexity of electric vehicle battery packs.

The Mercedes EQS test vehicle demonstrates these capabilities in real-world conditions. The 25% range improvement over conventional lithium-ion batteries translates to over 1,000 kilometers of driving range under WLTP testing conditions. This achievement moves electric vehicles closer to true parity with internal combustion engines in terms of practical usability, potentially eliminating range anxiety for the vast majority of drivers.

Factorial’s manufacturing strategy also sets them apart from competitors. Their 200 megawatt-hour pilot facility in Methuen, Massachusetts represents the largest solid-state battery production line in the United States. More crucially, the FEST technology’s compatibility with existing lithium-ion equipment means that established battery manufacturers can potentially retrofit their facilities rather than building entirely new production lines.

The Competitive Landscape: A Global Race for Solid-State Supremacy

The solid-state battery race has evolved into a complex geopolitical competition involving major automotive manufacturers, battery suppliers, and national governments. Each major player has adopted different technical approaches, creating a diverse ecosystem of competing technologies rather than a single dominant design.

Toyota and Idemitsu represent the Japanese approach, focusing on sulfide-based solid electrolytes. Their partnership aims to establish commercial production by 2027, with Idemitsu constructing a dedicated lithium-sulfide production facility capable of supporting 50,000 to 60,000 electric vehicles annually. However, sulfide electrolytes present unique challenges, including the emission of hydrogen sulfide gas when exposed to moisture during manufacturing—a safety concern that has contributed to Toyota’s repeated delays.

Samsung SDI leads Korean efforts with oxide-based solid-state technology targeting 900 watt-hours per liter energy density by 2027. Their approach prioritizes volumetric energy density over gravimetric density, potentially enabling more compact battery packs that could reshape vehicle design. Samsung’s substantial investment in pilot production facilities demonstrates their confidence in scaling this technology commercially.

The European response centers on BMW’s partnership with Solid Power, which is testing all-solid-state sulfide batteries in a modified i7 sedan on Munich roads. This collaboration represents a more conservative approach, focusing on proven sulfide chemistry while addressing manufacturing challenges through incremental improvements rather than revolutionary breakthroughs.

American efforts extend beyond Factorial to include QuantumScape, which recently achieved “baseline production” of their ceramic separator technology after years of development. However, QuantumScape’s approach requires completely new manufacturing processes, potentially limiting their ability to scale quickly compared to Factorial’s retrofit-compatible FEST technology.

This competitive diversity reflects the technical complexity of solid-state batteries and the absence of a clear optimal solution. Each approach involves different trade-offs between energy density, manufacturing complexity, cost, and safety—decisions that will ultimately determine which technologies achieve commercial success.

Technical Deep Dive: Understanding Solid-State Advantages and Challenges

Source: Mercedes

The fundamental advantage of solid-state batteries lies in their ability to use lithium metal anodes, which offer theoretical energy densities far exceeding conventional graphite anodes used in current lithium-ion batteries. Lithium metal provides the highest theoretical capacity of any anode material, but its practical implementation has been limited by dendrite formation and interface stability issues.

Solid electrolytes theoretically solve the dendrite problem by providing a physical barrier that prevents metallic lithium from forming the tree-like structures that cause battery failures. However, the reality proves more complex, as the interface between solid electrolyte and lithium metal must maintain intimate contact while accommodating the volume changes that occur during charging and discharging cycles.

Manufacturing solid-state batteries at scale introduces additional challenges that often prove more difficult than the fundamental chemistry. Solid-state cells require precise control of layer thickness, uniform compression during assembly, and ultra-low moisture environments to prevent degradation. These requirements translate to higher manufacturing costs and lower initial yields compared to established lithium-ion production.

The charging speed advantages demonstrated by Factorial’s technology stem from the elimination of liquid electrolyte limitations. Conventional lithium-ion batteries must manage ion transport through liquid media, which creates bottlenecks at high charging rates. Solid electrolytes can potentially support higher ion transport rates while generating less heat, enabling faster charging without thermal management concerns.

Safety represents another crucial advantage of solid-state designs. The elimination of flammable liquid electrolytes reduces fire risk and thermal runaway potential, possibly enabling passive cooling systems that simplify battery pack design. This safety improvement could prove particularly valuable in applications where battery damage might occur, such as accidents or extreme operating conditions.

However, solid-state batteries also introduce new failure modes that require careful engineering. Interface degradation between solid components can cause gradual performance loss, while mechanical stress from thermal cycling or vibration might create gaps that increase internal resistance. These challenges require sophisticated battery management systems and careful mechanical design to ensure long-term reliability.

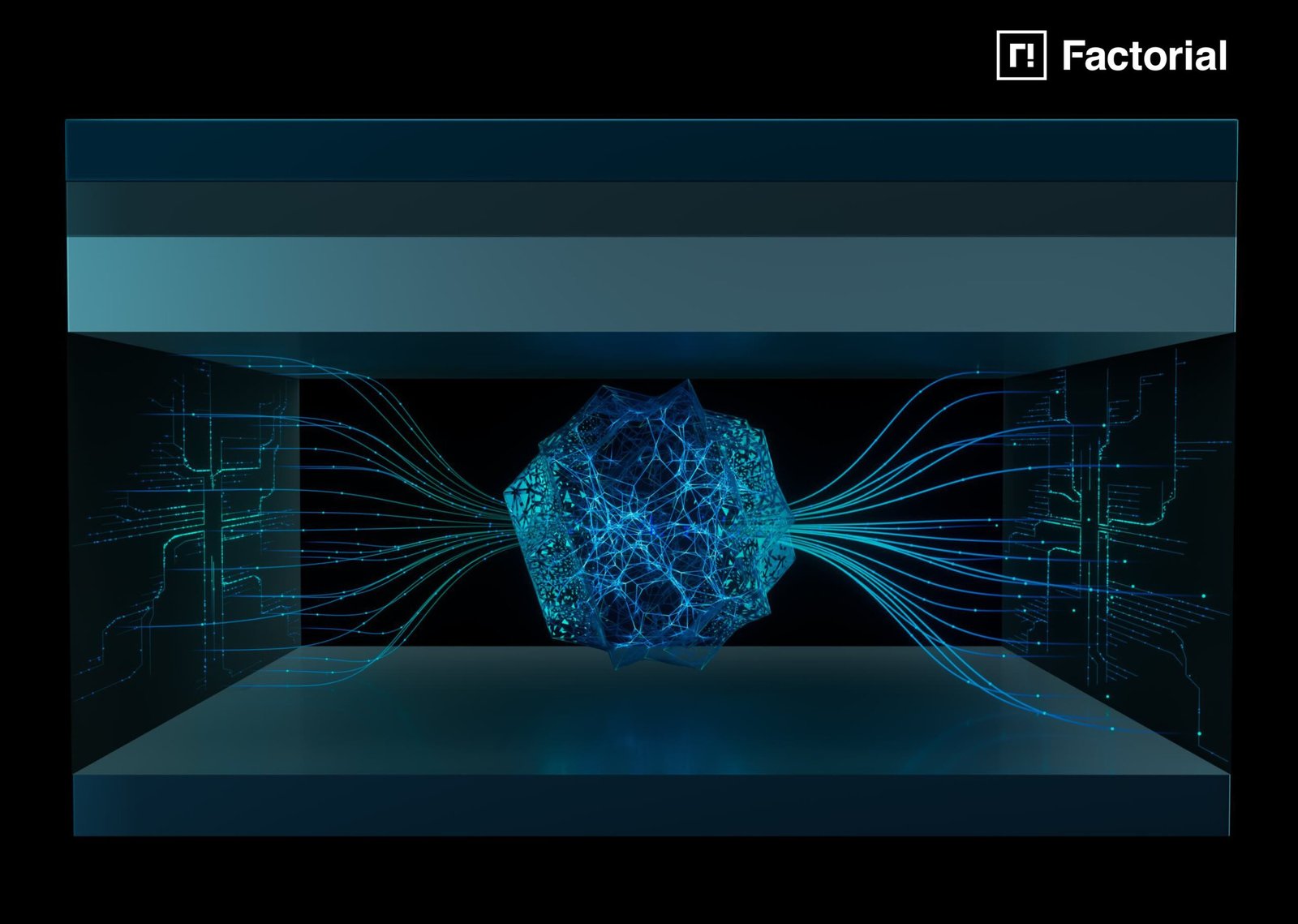

The Role of Artificial Intelligence in Accelerating Development

Source: Factorial

Factorial Energy’s introduction of Gammatron, their AI-enabled digital twin platform, represents a significant advancement in battery development methodology. Traditional battery research requires extensive physical testing, with individual cells undergoing hundreds or thousands of charge-discharge cycles to validate performance and longevity. This process typically requires months or years to generate sufficient data for commercial qualification.

Digital twin technology changes this paradigm by creating sophisticated computer models that can predict battery behavior under various conditions without physical testing. According to SAE International’s analysis, Gammatron correlates material properties, manufacturing parameters, and operating conditions to forecast performance, enabling rapid iteration and optimization that would be impossible through physical testing alone.

The AI system analyzes vast datasets from material science research, manufacturing process data, and real-world performance measurements to identify patterns and relationships that might escape human researchers. This capability proves particularly valuable for solid-state batteries, where the interactions between different solid components create complex behaviors that traditional testing approaches struggle to characterize efficiently.

Manufacturing optimization represents another crucial application of AI in solid-state battery development. The production of solid-state cells involves numerous variables including coating thickness, compression pressure, temperature profiles, and assembly sequences. AI systems can identify optimal parameter combinations that maximize yield while minimizing defects, potentially solving the manufacturing challenges that have limited previous solid-state attempts.

The competitive advantage provided by AI-accelerated development cannot be understated in an industry where time-to-market often determines commercial success. Companies that can iterate faster and identify optimal designs more quickly gain substantial advantages in securing partnerships with automotive manufacturers and establishing market position.

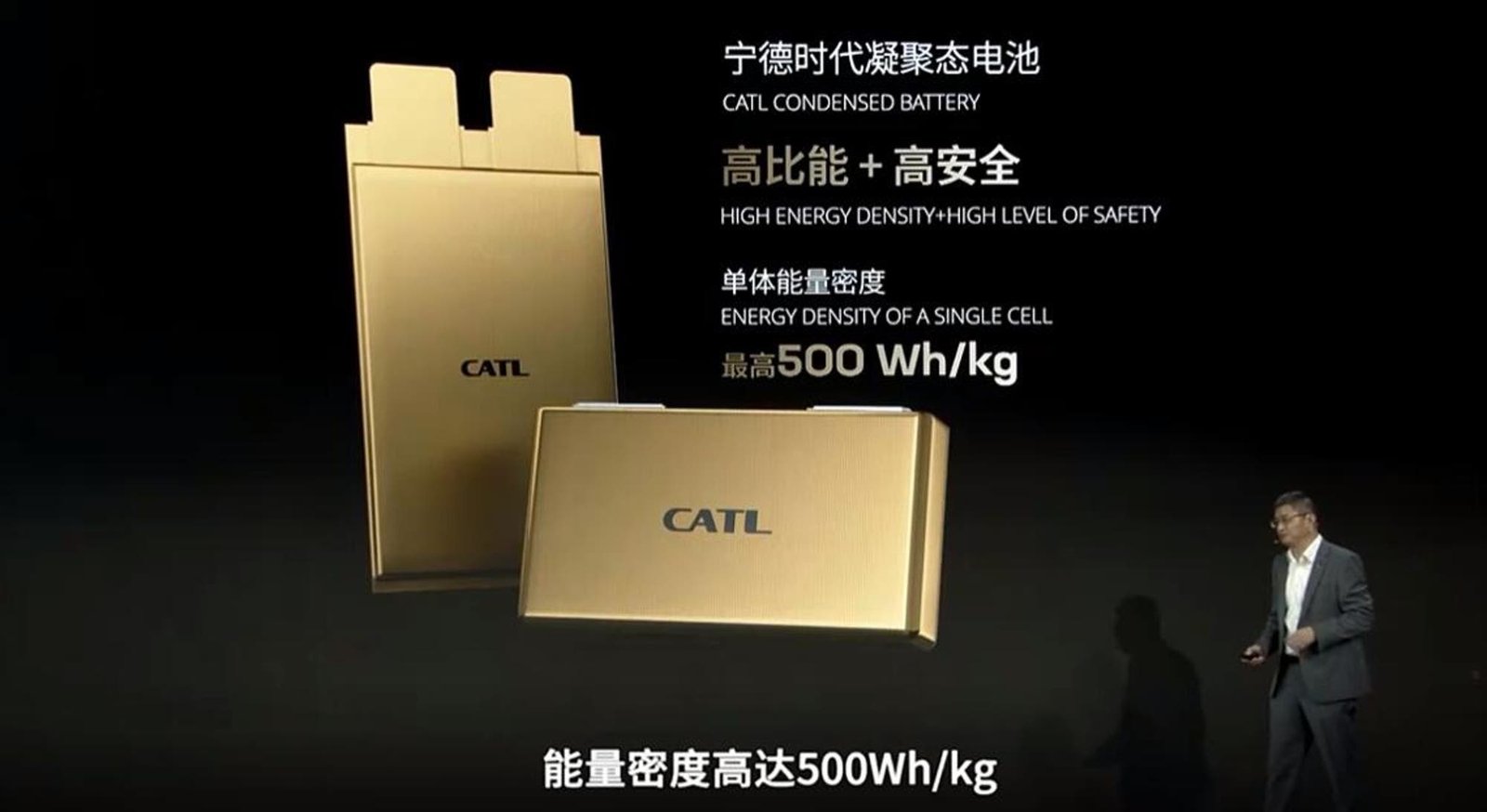

Industry Skepticism and Manufacturing Realities

Source: CATL

Despite the promising developments from Factorial and other solid-state battery companies, significant skepticism remains within the battery industry. Robin Zeng, chairman of CATL, the world’s largest battery manufacturer, has publicly dismissed solid-state commercialization as “years away,” as reported by Financial Times, arguing that current demonstrations represent laboratory achievements rather than scalable manufacturing solutions.

This skepticism stems from hard-learned lessons about the gap between laboratory performance and commercial viability. The battery industry has witnessed numerous breakthrough announcements that failed to materialize into products, creating a culture of caution regarding new technologies that lack proven manufacturing scalability.

CATL’s position reflects broader industry concerns about the economic viability of solid-state batteries. Current lithium-ion technology has achieved dramatic cost reductions, dropping to approximately $139 per kilowatt-hour in 2023 with projections reaching $80 per kilowatt-hour by 2026. Solid-state batteries must not only match these cost targets but also demonstrate superior performance to justify the investment required for new manufacturing infrastructure.

Manufacturing yield represents the most critical challenge facing solid-state battery commercialization. Laboratory cells can be produced with careful attention to each individual unit, but commercial viability requires consistent production of thousands of cells daily with minimal defects. The complex assembly processes required for solid-state batteries make achieving high yields significantly more challenging than established lithium-ion production.

Panasonic’s cautious approach to solid-state investment reflects similar concerns about manufacturing readiness. As one of the world’s largest battery manufacturers with extensive experience in automotive applications, Panasonic’s reluctance to commit heavily to solid-state technology indicates the substantial technical and financial risks involved in this transition.

The failure of previous solid-state ventures provides sobering context for current optimism. Sakti3, acquired by Dyson for $90 million, promised revolutionary solid-state performance but never achieved commercial production. The gap between laboratory demonstrations and manufacturing reality proved insurmountable despite substantial investment and technical expertise.

Geopolitical Implications and Supply Chain Considerations

Source: Mercedes

The solid-state battery race carries significant geopolitical implications as nations compete for leadership in next-generation energy storage technology. Understanding how China has achieved 55% global market dominance in batteries provides crucial context for why Western governments view solid-state technology as strategically important for reducing supply chain dependencies.

Solid-state technology represents an opportunity for American, European, and Japanese companies to regain competitive advantage in battery manufacturing. Factorial’s Massachusetts facility, Toyota’s Japanese production plans, and Samsung’s Korean operations all position non-Chinese companies to potentially break Chinese supply chain dominance if solid-state technology achieves commercial success.

However, solid-state batteries also create new supply chain dependencies that require careful consideration. Lithium metal production requires different processes and infrastructure compared to the lithium compounds used in conventional batteries. The specialized materials needed for solid electrolytes, such as the lithium-sulfide compounds planned for Toyota’s production, may create bottlenecks that limit scaling potential.

The integration of solid-state batteries into existing automotive supply chains presents additional challenges. Current electric vehicle manufacturers have invested heavily in lithium-ion battery pack designs, thermal management systems, and manufacturing processes optimized for conventional technology. Transitioning to solid-state batteries may require substantial re-engineering of vehicle platforms and production lines.

Trade policies and technology transfer restrictions also influence solid-state development strategies. The increasing restrictions on technology sharing between China and Western countries may limit collaboration opportunities while encouraging independent development programs that could duplicate efforts and increase overall development costs.

Timeline Reality: From Prototype to Production

Source: Mercedes

Based on current industry developments and historical precedents, a realistic timeline for solid-state battery commercialization extends across the remainder of this decade. The progression from prototype demonstration to mass production involves numerous validation steps that cannot be significantly accelerated regardless of technological sophistication.

2025-2026 will likely see expanded demonstration programs from multiple manufacturers. Mercedes-Benz plans continued testing of their EQS prototype, while Stellantis has committed to demonstration fleet deployment by 2026. These programs serve crucial roles in validating real-world performance and identifying potential issues that laboratory testing cannot reveal.

Limited commercial production may begin during 2026-2027, initially targeting premium vehicle segments where customers accept higher costs for advanced technology. Early production volumes will likely remain small, measured in thousands rather than millions of units annually, as manufacturers refine their processes and build confidence in long-term reliability.

Mass market integration appears realistic during 2028-2030, assuming successful resolution of manufacturing challenges and cost reduction through scale. However, this timeline depends on numerous factors including raw material availability, manufacturing yield improvements, and competitive pressure from advancing lithium-ion technology.

The transition will likely prove gradual rather than revolutionary, with solid-state batteries initially capturing niche applications before expanding into mainstream markets. Premium electric vehicles, aerospace applications, and stationary energy storage may adopt solid-state technology before it becomes economically viable for mass-market passenger vehicles.

Beyond 2030, solid-state batteries may achieve true cost parity with lithium-ion technology while offering superior performance, potentially triggering rapid market adoption. However, this outcome depends on successful execution of current development programs and continued investment in manufacturing infrastructure.

What This Means for the Electric Vehicle Market

The successful commercialization of solid-state batteries could fundamentally reshape the electric vehicle market by addressing many of the limitations that currently constrain EV adoption. Range anxiety, charging time concerns, and cold weather performance issues that affect current lithium-ion technology may become irrelevant with widespread solid-state deployment.

For consumers, solid-state batteries promise electric vehicles that more closely match the convenience and usability of internal combustion engines. The combination of extended range, rapid charging, and improved cold weather performance could eliminate most practical objections to electric vehicle ownership, potentially accelerating the transition away from fossil fuels.

Automotive manufacturers face strategic decisions about when and how to integrate solid-state technology into their product lines. Early adoption offers competitive advantages but requires substantial investment in new manufacturing capabilities and supply chain relationships. Conservative approaches minimize risk but may cede market position to more aggressive competitors.

The emerging competition between different solid-state approaches, as analyzed in our comprehensive comparison of solid-state battery technologies, will likely influence adoption patterns. Western manufacturers may prioritize solid-state technology as a pathway to reduce dependence on Chinese battery suppliers, while Chinese companies might focus on improving lithium-ion technology to maintain their current advantages.

Battery recycling and sustainability considerations also favor solid-state technology development. The longer lifespan and improved performance characteristics of solid-state batteries could reduce the total number of batteries required over vehicle lifetimes, while their solid construction may simplify recycling processes compared to liquid electrolyte systems.

The competitive landscape will likely remain dynamic as different technological approaches compete for market acceptance. Companies that successfully scale solid-state manufacturing while maintaining cost competitiveness will capture significant market share, while those that fail to execute may find themselves displaced by more successful competitors.

Looking Forward: The Next Phase of Battery Innovation

The emergence of working solid-state battery prototypes represents just one aspect of the broader transformation occurring in energy storage technology. Revolutionary developments like China’s nuclear battery technology promising 50-year operation demonstrate the accelerating pace of innovation in this critical technology sector.

The success of Factorial Energy and Mercedes-Benz provides validation for the broader solid-state development ecosystem while highlighting the importance of practical engineering over theoretical breakthroughs. Companies that focus on manufacturing scalability and real-world performance rather than laboratory achievements appear most likely to achieve commercial success.

Investment patterns in battery technology reflect growing confidence in solid-state potential while maintaining awareness of associated risks. Venture capital, corporate investment, and government funding continue flowing toward solid-state development, but with increasingly sophisticated evaluation criteria that emphasize manufacturing readiness and commercial viability.

The integration of artificial intelligence and advanced materials science will likely accelerate future battery developments beyond current solid-state achievements. The combination of AI-driven design optimization, advanced manufacturing techniques, and improved understanding of solid-state interfaces may enable performance improvements that exceed current projections.

For technology enthusiasts and industry observers, the solid-state battery revolution represents a compelling example of how persistent research and development can overcome seemingly intractable technical challenges. The transition from failed prototypes to working vehicles demonstrates the value of sustained investment in fundamental research combined with practical engineering focus.

As we monitor the continued development of solid-state battery technology, the key metrics to watch include manufacturing yield rates, cost per kilowatt-hour achievements, and real-world durability data from extended testing programs. These practical measures will ultimately determine whether solid-state batteries fulfill their revolutionary potential or remain a promising technology that never achieves widespread commercial success.

The coming years will prove crucial for the solid-state battery industry as multiple companies attempt to scale their technologies from prototype to production. Success will require not only technical excellence but also substantial capital investment, manufacturing expertise, and strategic partnerships with automotive manufacturers. The companies that successfully navigate this transition will likely define the future of electric vehicle technology and energy storage for decades to come.

Understanding comprehensive battery technology developments across different approaches provides essential context for evaluating the significance of solid-state breakthroughs within the broader energy storage landscape. The ultimate success of solid-state technology will depend not only on its absolute performance but also on its competitiveness relative to continuously improving alternatives.

Recommended Tools and Platforms

Creating engaging content about breakthrough technologies like solid-state batteries requires access to professional tools and platforms. Whether you’re developing educational videos, newsletters, or marketing materials about emerging technologies, these carefully selected resources can help enhance your content creation process:

Video Creation and Editing:

- Fliki – Turn Text into Video (20% OFF) – Transform technical articles into engaging video content with AI-powered narration

- Pictory – AI Video Creation (20% OFF with Code: CuriosityAI) – Create professional technology explainer videos from blog posts and scripts

- Synthesia – Create AI Avatar Videos – Develop educational content with AI presenters for complex technical topics

Content Marketing and SEO:

- vidIQ – YouTube Growth & SEO – Optimize technology content for better discovery and engagement

- AdCreative.ai – AI-Powered Ad Designs – Create compelling visuals for technology and innovation content

Communication and Newsletter Platforms:

- Beehiiv – Build Your Own Newsletter – Share breakthrough technology insights with engaged audiences

- ElevenLabs – Realistic AI Voiceovers – Professional narration for educational content about emerging technologies

Online Security for Research:

- Surfshark VPN – Online Privacy Tool – Secure research access when investigating global technology developments

These tools complement our educational mission by enabling content creators to effectively communicate complex technological concepts to broader audiences. The rapid pace of battery technology development requires sophisticated content creation capabilities to keep pace with breakthrough announcements and industry developments.